Food Coating Market: Growth Opportunities and Recent Developments

The food coating ingredients and equipment markets were valued at USD 2.60 billion and USD 1.87 billion, respectively, in 2017 and are projected to reach a value of USD 3.62 billion and USD 2.21 billion by 2023, at a CAGR of 5.8% and 3.7%

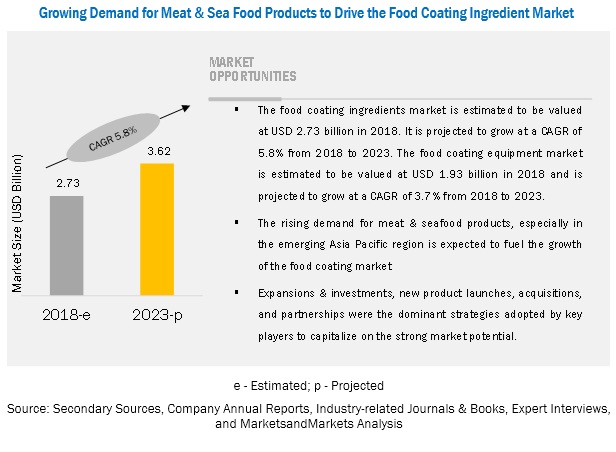

Northbrook, USA, 2021-Apr-28 — /EPR Network/ —The report “Food Coating Market by Ingredient Type (Batter, Flours), Application (Bakery, Snacks), Equipment Type (Coaters & Applicators, Enrobers), Form (Dry, Liquid), Mode of Operation (Automatic, Semi-Automatic), and Region – Global Forecast to 2023″, The food coating ingredients and equipment markets are estimated to be valued at USD 2.73 billion and USD 1.93 billion, respectively, in 2018 and are projected to reach USD 3.62 billion and USD 2.31 billion, respectively, by 2023, at a CAGR of 5.8% and 3.7% from 2018 to 2023. The market is driven by factors such as rising demand for meat & seafood, poultry, bakery products, and confectionery products, growing demand for processed & convenience food, increased focus on production efficiency, processing time, and quality of food products, growing demand for innovative food coating products due to changing consumer trends.

Report Objectives:

- Determining and projecting the size of the food coating market, with respect to form, ingredient, application, and region, over a five-year period ranging from 2018 to 2023

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling key market players in the food coating market

- Determining the market share of key players operating in the food coating market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

Market Dynamics:

Growing food processing in meat, bakery, snacks, and breakfast cereal

Meat, snacks, bakery products, and breakfast cereal are some of the major applications of food coating ingredients and equipment. The fast changing and busy lifestyles of consumers due to rapid urbanization have also led to a high demand for ready-to-eat and ready-to-cook meat, confectionery products, and bakery food products as they are processed food products that require less time and effort to cook, while also ensuring nutrition and durability. Furthermore, rising inclination of consumers toward protein-based food products, popularity of frozen food, and the growing frequency of snacking are driving the demand for these products in the market, leading to the growth in demand for ingredients such as spices, fats and oils, cocoa, flours, and sugar and syrups. As a result, the demand of equipment such as coaters, applicators, and enrobers is also expected to rise. Due to the growing demand for healthy food products in Europe, the demand for gluten-free bakery products has also increased in many European countries between 2010 and 2014. Increase in product launches has also resulted in higher demand for gluten-free flours and other ingredients used in the bakery industry, in turn, driving the market for food coating ingredients in the region.

Rising costs of production due to fluctuating ingredient prices is a major restraint for the market.

Rising prices of ingredients and their subsequent fluctuations have emerged as key restraints in food coating. The high cost of ingredients has led to high production cost, which further hinders the chances of adoption of new coating technologies by the manufacturer due to the resultant lower margins and longer time taken to attain breakeven point for food manufacturers. The food coating equipment must thus offer cost effectiveness in terms of output and ingredient usage to make up for the rising ingredient prices and make it easier for food manufacturers to achieve economies of scale. For instance, the prices of cocoa beans and sugar, which are the major ingredients used in coating confectionery, chocolates, and snacks increased continuously between 2013 and 2016, leading to high cost of the end product, which, in turn, leads manufacturers to focus on cutting cost, rather than investments on new technologies or equipment in their manufacturing facilities.

The meat & sea food segment is estimated to account for the largest market in 2018 for both the food coating ingredient and equipment market.

On the basis of application, the meat & sea food segment is expected to account for the largest share. The market is mainly driven by the large scale usage in North America. Coating for meat & sea food products to protect them from spoilage. This allows the addition of savory flavors and crispy texture of meat and seafood products. In addition to this, America’s increasing consumption of crispy, fried chicken, coated with batter and crumbs is driving the market for this application steadily.

The semi-automatic mode of operation is expected to show the highest growth rate in the next five years.

The semi-automatic segment is projected to grow at the highest growth rate in the next five years. Semi-automatic food coating equipment is usually adopted by small- and medium-scale manufacturers, as their production scale is limited. Developing countries in the Asia Pacific and South American regions that have a large number of small and medium manufacturers of food processing products utilize semi-automated equipment. Limited investment capacity and high labor availability are the major drivers that have led to the use of semi-automated equipment in these regions.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=168532529

North America is estimated to dominate the food coating ingredient market in 2018.

North America is expected to continue its dominant presence in the food coating ingredients market during the forecast period. The region is backed by superior food coating technologies and utilizes automatic equipment for coating food ingredients. Consumers in the US and Canada majorly consume salty snacks such as potato chips, which need dry coating. Apart from this, these countries consume frozen food that requires coating for an extended shelf life. Consumers in this region opt for cereal as breakfast options where coating is applied. The US is also a huge market for confectionery products. These factors have fueled the growth of the food coating market in North America.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes profiles of leading companies such Marel (Iceland), GEA Group (Germany), Bühler AG (Switzerland), JBT Corporation (US), TNA Australia Pty Limited (Australia), Clextral (France), Dumoulin (France), Spice Application Systems (UK), Cargill (US), Kerry Group (Iceland), Tate & Lyle Plc (UK), Newly Weds Foods (US), PGP International (US), Archer Daniels Midland Company (US), Ingredion Incorporated (US), and Bowman Ingredients (UK).

Recent developments:

- In June 2018, Kerry invested in the expansion of its Wittstock breadcrumb manufacturing facility in Germany. This expansion will help the company to better serve its customers in the European region. The expansion is expected to involve the installation of a new crumb baking line and a warehouse extension.

- In March 2018, Tate & Lyle PLC teamed up with HORN (California), a North America-based premier distributor of specialty ingredients and raw materials. Under this partnership, HORN distributes Tate & Lyle’s specialty ingredients developed for the nutrition industry in the US. This will provide mutual growth opportunities and increased access to innovative products in the markets the company serves.

- In March 2017, Ingredion acquired the rice starch & rice flour business from Sun Flour Industry Co, Ltd. (Thailand). This acquisition helped the company to expand its specialty ingredients portfolio.