Wearable Payments Devices Market Share, Variables, Trends, Regional Scope and Raw Material Outlook, 2028

Posted on 2022-08-10 by researchinsights in Industrial, Technology // 0 Comments

San Francisco, Calif., USA, Aug 10, 2022 — /EPR Network/ —

Wearable Payments Devices Industry Overview

The global wearable payments devices market size was valued at USD 10.35 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 29.8% from 2021 to 2028. The market growth can be attributed to the increasing demand for Host Card Emulation (HCE) and the growing adoption of cashless transactions. HCE allows mobile or wearable devices to permit card imitation on NFC-enabled devices without depending on access to an authenticated element. Furthermore, the increasing demand for wearable payment devices owing to their fast payment capability is expected to fuel the market growth over the forecast period. Numerous e-banking platforms are adopting wearable payment devices. These platforms are focusing on integrating the Near Field Communication (NFC) technology into their transaction operations, which facilitates seamless payments. Furthermore, the decreasing costs for deploying NFC technology are encouraging the rise in demand for the technology. Businesses widely use this technology to transfer data from their devices to various contactless payment terminals, such as NFC tags and smartphones.

The rapid growth in the use of contactless payments is driven by the mandates of digital payment networks by the governments across the globe, which, as a result, has increased the adoption of payment-enabled devices. Wearable payments offer a quick and convenient way of making payments, specifically for small to medium-sized monetary transactions. Factors such as the increasing integration of NFC payment systems in mobile devices increased comfort with using contactless cards, and the rising adoption of contactless point-of-sale readers are expected to create growth opportunities for the market over the forecast period. Additionally, the growth in IoT globally acts as a major driver for invisible payments, thereby propelling the market growth over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global Wearable Payments Devices market

The market is significantly driven by the increase in digitization, followed by the growing adoption of a cashless economy observed in several countries. The use of smart technologies, coupled with rising internet penetration, has resulted in the increased adoption of connected devices. Furthermore, the market growth is influenced by the presence of VR and AI technologies, which is driven by developments in mobile applications. Digitization in banks is expected to gain traction as banks are focusing on connecting card management systems with various token service providers.

The outbreak of COVID-19 is anticipated to favorably impact market growth over the forecast period. In this time of the pandemic, customers across the globe are preferring contactless payments as a mode of payment, which is expected to fuel the adoption of wearable payment devices. However, factors such as the limited battery life of the devices, high cost of the devices, and security concerns are expected to hamper the market growth. The high costs of devices impact the ability of manufacturers to launch their products in the market, thus resulting in limited production. These payment devices are costly, which restricts various consumers from purchasing these devices. Additionally, the rising competition in the market and low awareness about the product are further limiting the market growth.

Browse through Grand View Research’s Technology Industry Related Reports

Contactless Payment Market – The global contactless payment market size was valued at USD 1.34 trillion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 20.3% from 2021 to 2028.

Digital Payment Market – The global digital payment market size was valued at USD 68.61 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.5% from 2022 to 2030.

Wearable Payments Devices Industry Segmentation

Grand View Research has segmented the global wearable payments devices market based on device type, technology, application, and region:

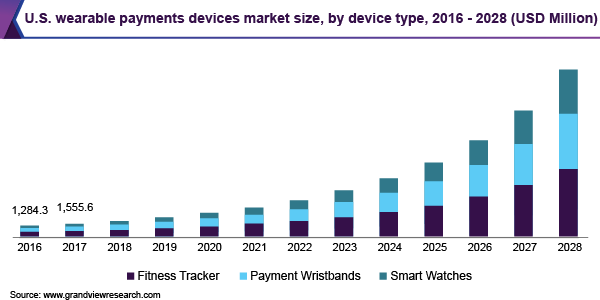

Wearable Payments Devices Type Outlook (Revenue, USD Million, 2016 – 2028)

- Fitness Tracker

- Payment Wristbands

- Smart Watches

Wearable Payments Devices Technology Outlook (Revenue, USD Million, 2016 – 2028)

- Barcodes

- Contactless Point of Sale (POS) Terminals

- Near Field Communication (NFC)

- Quick Response (QR) Codes

- Radio Frequency Identification (RFID)

Wearable Payments Devices Application Outlook (Revenue, USD Million, 2016 – 2028)

- Festival & Life Events

- Fitness

- Healthcare

- Retail

- Transportation

- Others

Wearable Payments Devices Regional Outlook (Revenue, USD Million, 2016 – 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

April 2016: Jawbone, in collaboration with American Express, launched the NFC chip-enabled UP4 fitness band. This wristband allows users to pay directly from their devices.

Key Companies profiled:

Some prominent players in the global Wearable Payments Devices Industry include

- Apple, Inc.

- Barclays PLC

- Gemalto NV

- Google LLC

- Mastercard

- Nymi

- PayPal Holdings Inc.

- Samsung Electronics

- Visa Inc.

- Wirecard

Order a free sample PDF of the Wearable Payments Devices Market Intelligence Study, published by Grand View Research.

Matched content

Editor’s pick

- Digi Communications N.V. announces share transaction made by an Executive Director of the Company with class B shares

- BevZero South Africa Achieves FSSC 22000 Food Safety Certification

- Digi Communications N.V.: Digi Spain Enters Agreement to Sell FTTH Network to International Investors for Up to EUR 750 Million

- Patients as Partners® Europe Announces the Launch of 8th Annual Meeting with 2024 Keynotes and Topics

- driveMybox continues its international expansion: Hungary as a new strategic location

- Monesave introduces Socialised budgeting: Meet the app quietly revolutionising how users budget

- Digi Communications NV announces the release of the 2023 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the presentation of the 2023 Preliminary Financial Results

- Lensa, един от най-ценените търговци на оптика в Румъния, пристига в България. Първият шоурум е открит в София

- Criando o futuro: desenvolvimento da AENO no mercado de consumo em Portugal

- Digi Communications N.V. Announces the release of the Financial Calendar for 2024

- Customer Data Platform Industry Attracts New Participants: CDP Institute Report

- eCarsTrade annonce Dirk Van Roost au poste de Directeur Administratif et Financier: une décision stratégique pour la croissance à venir

- BevZero Announces Strategic Partnership with TOMSA Desil to Distribute equipment for sustainability in the wine industry, as well as the development of Next-Gen Dealcoholization technology

- Digi Communications N.V. announces share transaction made by a Non-Executive Director of the Company with class B shares

- Digi Spain Telecom, the subsidiary of Digi Communications NV in Spain, has concluded a spectrum transfer agreement for the purchase of spectrum licenses

- Эксперт по торговле акциями Сергей Левин запускает онлайн-мастер-класс по торговле сырьевыми товарами и хеджированию

- Digi Communications N.V. announces the conclusion by Company’s Portuguese subsidiary of a framework agreement for spectrum usage rights

- North Texas Couple Completes Dream Purchase of Ouray’s Iconic Beaumont Hotel

- Предприниматель и филантроп Михаил Пелег подчеркнул важность саммита ООН по Целям устойчивого развития 2023 года в Нью-Йорке

- Digi Communications NV announces the release of the Q3 2023 Financial Results

- IQ Biozoom Innovates Non-Invasive Self-Testing, Empowering People to Self-Monitor with Laboratory Precision at Home

- BevZero Introduces Energy Saving Tank Insulation System to Europe under name “BevClad”

- Motorvision Group reduces localization costs using AI dubbing thanks to partnering with Dubformer

- Digi Communications NV Announces Investors Call for the Q3 2023 Financial Results

- Jifiti Granted Electronic Money Institution (EMI) License in Europe

- Предприниматель Михаил Пелег выступил в защиту образования и грамотности на мероприятии ЮНЕСКО, посвящённом Международному дню грамотности

- VRG Components Welcomes New Austrian Independent Agent

- Digi Communications N.V. announces that Digi Spain Telecom S.L.U., its subsidiary in Spain, and abrdn plc have completed the first investment within the transaction having as subject matter the financing of the roll out of a Fibre-to-the-Home (“FTTH”) network in Andalusia, Spain

- Продюсер Михаил Пелег, как сообщается, работает над новым сериалом с участием крупной голливудской актрисы

- Double digit growth in global hospitality industry for Q4 2023

- ITC Deploys Traffic Management Solution in Peachtree Corners, Launches into United States Market

- Cyviz onthult nieuwe TEMPEST dynamische controlekamer in Benelux, Nederland

- EU-Funded CommuniCity Launches its Second Open Call

- Astrologia pode dar pistas sobre a separação de Sophie Turner e Joe Jonas

- La astrología puede señalar las razones de la separación de Sophie Turner y Joe Jonas

- Empowering Europe against infectious diseases: innovative framework to tackle climate-driven health risks

- Montachem International Enters Compostable Materials Market with Seaweed Resins Company Loliware

- Digi Communications N.V. announces that its Belgian affiliated companies are moving ahead with their operations

- Digi Communications N.V. announces the exercise of conditional share options by an executive director of the Company, for the year 2022, as approved by the Company’s Ordinary General Shareholders’ Meeting from 18 May 2021

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2022 financial year

- Digi Communications N.V. announces the availability of the 2022 Annual Report

- Русские эмигранты усиливают призывы «Я хочу, чтобы вы жили» через искусство

- BevZero Introduces State-of-the-Art Mobile Flash Pasteurization Unit to Enhance Non-Alcoholic Beverage Stability at South Africa Facility

- Russian Emigrés Amplify Pleas of “I Want You to Live” through Art

- Digi Communications NV announces the release of H1 2023 Financial Results

- Digi Communications NV Announces Investors Call for the H1 2023 Financial Results

- Digi Communications N.V. announces the convocation of the Company’s general shareholders meeting for 18 August 2023 for the approval of, among others, the 2022 Annual Report

- “Art Is Our Weapon”: Artists in Exile Deploy Their Talents in Support of Peace, Justice for Ukraine

- Digi Communications N.V. announces the availability of the 2022 Annual Financial Report

- “AmsEindShuttle” nuevo servicio de transporte que conecta el aeropuerto de Eindhoven y Ámsterdam

- Un nuovo servizio navetta “AmsEindShuttle” collega l’aeroporto di Eindhoven ad Amsterdam

- Digi Communications N.V. announces the conclusion of an amendment agreement to the Facility Agreement dated 26 July 2021, by the Company’s Spanish subsidiary

- Digi Communications N.V. announces an amendment of the Company’s 2023 financial calendar

- iGulu F1: Brewing Evolution Unleashed

- Почему интерактивная «Карта мира» собрала ключевые антивоенные сообщества россиян по всему миру и становится для них важнейшим инструментом

- Hajj Minister meets EU ambassadors to Saudi Arabia

- Online Organizing Platform “Map of Peace” Emerges as Key Tool for Diaspora Activists

- Digi Communications N.V. announces that conditional stock options were granted to executive directors of the Company based on the general shareholders’ meeting approval from 18 May 2021

- Digi Communications N.V. announces the release of the Q1 2023 financial results

- AMBROSIA – A MULTIPLEXED PLASMO-PHOTONIC BIOSENSING PLATFORM FOR RAPID AND INTELLIGENT SEPSIS DIAGNOSIS AT THE POINT-OF-CARE

- Digi Communications NV announces Investors Call for the Q1 2023 Financial Results presentation

- Digi Communications N.V. announces the amendment of the Company’s 2023 financial calendar

- Digi Communications N.V. announces the conclusion of two Facilities Agreements by the Company’s Romanian subsidiary

- Digi Communications N.V. announces the conclusion of a Senior Facility Agreement by the Company’s Romanian subsidiary

- Africa Luxury Trips, Luxury Accommodations, Tours, Excursions, Attractions and Vacation Holidays in Nairobi, Kenya

- Patients as Partners Europe Returns to London and Announces Agenda Highlights

- GRETE PROJECT RESULTS PRESENTED TO TEXTILE INDUSTRY STAKEHOLDERS AT INTERNATIONAL CELLULOSE FIBRES CONFERENCE

- Digi Communications N.V. announces Digi Spain Telecom S.L.U., its subsidiary in Spain, entered into an investment agreement with abrdn to finance the roll out of a Fibre-to-the-Home (FTTH) network in Andalusia, Spain

- XSpline SPA / University of Linz (Austria): the first patient has been enrolled in the international multicenter clinical study for the Cardiac Resynchronization Therapy DeliveRy guided by non-Invasive electrical and VEnous anatomy assessment (CRT-DRIVE)

- Franklin Junction Expands Host Kitchen® Network To Europe with Digital Food Hall Pioneer Casper

- Unihertz a dévoilé un nouveau smartphone distinctif, Luna, au MWC 2023 de Barcelone

- Unihertz Brachte ein Neues, Markantes Smartphone, Luna, auf dem MWC 2023 in Barcelona

- AirLegit Partners with Applied Warranty & Insurance Services to Offer Travel Insurance Throughout the U.S.

- Digi Communications N.V. announces conditional stock options granted to a Director of the Company based on the general shareholders’ meeting approval from 28 December 2022

- Digi Communications N.V. announces the release of the 2022 Preliminary Financial Results

- CAMPAIGNS FOR HUMANITY: MARKETING AGENCY ANNOUNCES €10,000 AWARDS FOR RUSSIANS SUPPORTING UKRAINE

- One Year Since the Invasion: New Series Highlights Everyday People Transformed by War into Heroes

- Digi Communications N.V. announces Investors Call for the presentation of the 2022 Preliminary Financial Results

- BevZero Receives Top Environmental Certification

- Thompson Duke Industrial Attains CE Certification for its Cannabis Vaporizer Cartridge Filling Equipment

- New Hires Underscore ChannelWorks’ Commitment to Global Expansion of IT Services Organization

- Modern Media Hub Takes Huge Leap with Financing Help of Cap Expand Partners

- Cruzeiro Safaris Kenya Tour Operator launches Family Vacations Safari Booking for Nairobi City Tours and Luxury Safaris

- Digi Communications N.V. announces the release of the Financial Calendar for 2023

- Digi Communications N.V. announces the exercise of stock options by two of the Directors of the Company

- Tanduay Is First Asian Rum to Enter Austrian Market

- Digi Communications N.V. Announces the Resolutions of the General Shareholders’ Meeting from 28 December 2022, approving, amongst others, the 2021 Annual Accounts

- MIGUN LIFE's new personal healthcare products are unveiled, heralding the grand first debut at CES 2023

- Digi Communications N.V. announces that the Romanian version of the Annual Financial Report for the year ended December 31, 2021 for the Digi Communications N.V. Group is available

- Up to 80% off Saint Lucia for Black Friday & Cyber Monday: Dedicated Site Features More Than Two Dozen Hotels, Villas, Resorts, B&Bs and Local Experiences

- Digi Communications N.V. Announces Convocation of the Company’s general shareholders meeting for 28 December 2022 for the approval of, among other items, the 2021 Annual Report

- Digi Communications N.V. Announces the availability of the Annual Financial Report for the year ended December 31, 2021 for Digi Communications N.V. Group

- Digi Communications N.V.’s Romanian subsidiary was designated winner of the auction organised for the allocation of certain radio frequency entitlements in 2600 MHz and 3400-3800 MHz bands

- Digi Communications NV announces the release of the Q3 2022 Financial Results

- First Look: InterContinental Chiang Mai Mae Ping ushers in a new era of luxury

- Digi Communications N.V. announces a Subsequent Amendment of the Company’s 2022 financial calendar

- Digi Communications NV announces Investors Call for the Q3 2022 Financial Results presentation

- Sygnum Bank and Artemundi tokenize Warhol’s Marilyn Monroe artwork

- Your Daily Commutes Will be Seamless, Connected and Productive.

- The secondary market platform THELAPHANT.IO introduces, for the first time in Israel: "a stock liquidity plan" for high-tech employees and companies

- Teavaro and CDP Institute Offer Free Online Course on Identity Resolution

- Digi Communications N.V. announces a Subsequent Amendment of the Company’s 2022 financial calendar

- Digi Communications N.V. announces an Amendment of the Company’s 2022 financial calendar

- Tree Service Pros Altamonte Springs Tree Trimming and Dead Tree Removal Simultaneously

- 12-month real-world achievements for Diabeloop’s Automated Insulin Delivery (AID):

- Digi Communications N.V. announces the availability of the Instruction regarding the Payment of Dividends for the Financial Year 2021

- Simplify Content za usluge organskog Content Marketinga otvara svoja vrata poduzećima da (zajedno) uspješno kreiraju kvalitetan i relevantan sadržaj za potencijalne i postojeće klijente

- Digi Communications N.V. announces the approval of interim dividend distribution and updates regarding the 2022 Financial Calendar

- Cruzeiro Safaris Kenya Tour Operator launches Family Vacations Safari Booking for Nairobi City Tours and Luxury Safaris

- Cruzeiro Safaris Kenya offers Luxury Safaris and Nairobi City Tours for the whole family to enjoy

- A new, creativity-based educational method increases the ability to solve problems with young people, in the social field, or when building a team in the company

- Digi Communications NV announces the release of the H1 2022 Financial Results

- Probax Launches Object Storage Powered By Wasabi To Partners In North America, Australia, Singapore and Europe

- Mit Intelligenz geladen

- Digi Communications NV announces Investors Call for the H1 2022 Financial Results

- Digi Communications N.V. Announces the update of its 2022 Financial Calendar

- Digi Communications N.V. Announces the conclusion by the Company’s Spanish subsidiary of an amendment agreement to the facility agreement dated 26 July 2021

- Customer Data Platform Industry Grew Strongly in First Half of 2022: CDP Institute Report

- Metadeq Announces Breakthrough Non-Invasive Blood Test that Solves NASH Diagnosis Problem

- Η HBC Consulting Expert θεωρεί παράλογη την εμπλοκή του κυπριακού δικαστηρίου στην υπόθεση κληρονομιάς από τη χήρα του ολιγάρχη Μπόσοφ

- Esperto della società di consulenza HBC: le autorità italiane non hanno permesso a Katerina Bosov di vendere la villa del marito

- HBC Consulting Expert considers senseless the involvement of the Cypriot court in the case of inheritance by the widow of oligarch Bosov

- Fusion BPO Services is Opening New Center in Kosovo

- Hi-SIDE demonstrates an integrated high speed satellite data chain architecture at data rates exceeding 10 Gigabits per second

- Digi Communications N.V. announces that a joint venture of its subsidiary in Romania designated as one of the winners of the auction organized by the Belgian Institute for Postal Services and Telecommunications for the allocation of mobile spectrum frequency user rights

- Cruzeiro Safaris shares tips and ideas on Wildlife Safaris and Nairobi Tours in Kenya

- KI-basierte Geldanlage für Privatpersonen – Velvet AutoInvest erhält 1,3 Mio. USD Seed-Investment

- Haizol Now Offer 3D Printing Services to Customers Worldwide

- Caravel Capital Fund Showcased At Secure Spectrum’s Hedge Fund Seminar

- Diabeloop, a key player in therapeutic AI applied to insulin delivery, announces 70 million euros new financing round to accelerate its international expansion

- Digi Communications NV Announces Availability of the 2021 Preliminary Annual Report (including the Company’s audited non-statutory Consolidated financial statements issued as per IFRS EU)

- Digi Communications N.V. Announces that conditional stock options were granted to executive directors of the Company and to directors and employees of the Company’s Romanian Subsidiary

- Caravel Capital Investments Inc. Founding Partner to Speak at Secure Spectrum Hedge Fund Seminar

- Digi Communications NV announces a correction of clerical errors by Amending the Q1 2022 Financial Report

- Digi Communications NV announces the release of Q1 2022 Financial Results

- Cruzeiro Safaris shares tips and ideas on Wildlife Safaris and Nairobi Tours in Kenya

- Vacation Ideas to Book Wildlife Safaris and Nairobi Tours to Kenya By Cruzeiro Safaris

- Wacky Independent Comedy Romp “Stroke of Luck” Goes Global at Cannes

- Digi Communications N.V. announces Investors Call for the Q1 2022 Financial Results presentation

- Yield Crowd Tokenizes US $50M Real Estate Portfolio on Stellar Blockchain

- Digi Communications N.V. Announces an Amendment to the Financial Calendar for 2022

- Former Uber Driver Creates Cryptocurrency Banq potentially Worth Millions

- Diabeloop presents new real-life results of DBLG1® System: Confirmed improvement in Time In Range +18.4 percentage points; Reduction of time spent in hypoglycemia to only 0.9%

- How two female entrepreneurs are redefining the lake travel industry

- Vil du være med å utvikle fremtidens bærekraftige reiseliv?

- Mettiti alla prova con la terza edizione del CASSINI Hackathon per rivitalizzare il settore turistico

- Προκαλέστε τον εαυτό σας στο 3ο CASSINI Hackathon και στοχεύστε την αναζωογόνηση του τουρισμού!

- Participez au 3e Hackathon CASSINI et relevez le défi de redynamiser le tourisme!

- 3. CASSINI Hackathon zur Neubelebung des Tourismus: Stellen Sie sich der Herausforderung!

- Írd újra Európa turizmusát a 3. CASSINI Hackathonon!

- Aceita o desafio do 3º CASSINI Hackathon para revitalizar o turismo!

- Podejmij wyzwanie! Weź udział w 3. Hackathonie CASSINI i pomóż ponownie ożywić turystykę!

- Daag jezelf uit op de 3e CASSINI Hackathon en blaas toerisme nieuw leven in

- Diabeloop adapts its self-learning, personalized insulin automatization software to be used with insulin pens

- Art Exhibition of Hikari Sato's artwork in Japan

- Hikari Sato's journey of study overseas

- Hikari Sato Participated in Nuclear Wastewater Protest

- Amadeus unveils five defining trends for the US group travel and events industry in 2022

- On World Bipolar Day ALCEDIAG announces EIT Health supported EDIT-B Consortium validating innovative blood diagnostic test for bipolar disorder

- Silencil Reviews: A Scam Supplement Or Does It Really Treat Tinnitus - Critical Silencil Review

- Global & Europe Mental Health Software and Devices Market to Witness a Revenue of USD 13367.12 Million by 2030 by Growing with a CAGR of 13.28% During 2021-2030; Increasing Concern for Mental Health Disorders to Drive Market Growth

- Cole & Van Note Announces Mon Health Data Breach Investigation

- Cole & Van Note Announces Sedgwick CMS Data Breach Investigation

- Cole & Van Note Announces SAC Health System Data Breach Investigation

- Cole & Van Note Announces FPI Management Data Breach Investigation

- Cole & Van Note Announces Logan Health Medical Center Data Breach Investigation

- Cole & Van Note Announces Meyer Corporation Data Breach Investigation

- Digi Communications NV announces the release of the 2021 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the 2021 Preliminary Financial Results presentation

- At MWC in Barcelona, Amphenol will be exhibiting its wide offering for wireless service providers – including Open RAN compatible active 5G antennas

- ELIOS combined with cataract surgery delivers significant IOP reduction out to 8 years

- Tableau comparatif des pays : les caractéristiques à connaître avant de se développer à l’international

- Zante 2022 : the Best Season Ever

- TikTok and Instagram MUST-Do Challenge in Dubai!

- Smart exosomes from an Australian technology leader

- Bucharest Digi Communications N.V. announces Share transaction made by an executive director of the Company with class B shares

- Transmetrics AI is Applied by DB Schenker to Improve Land Transport Network in Bulgaria

- Digi Communications N.V.: Announces repayment of an aggregate amount of approx. EUR 272 million of the Group’s financial debt

- SkyRFID Move to USA Complete for 2022

- El Liceo Europeo vence el Premio Zayed a la Sustentabilidad 2022 en Europa y Asia Central

- Wind teams up with iDenfy to make their eco-friendly transportation easier and faster to get on board with

- Framework rebrands to daappa, heralding a new phase in fintech solutions designed for private markets

- Digi Communications N.V. Announces the publishing of the Financial Calendar for 2022

- Manufacturing giant Haizol expands their offices in China

- Patients and R&D Leaders Jointly Present at EU Conference on Progress with Patient-Input to Transform Medicine Development

- Seminário Bíblico sobre “O Cumprimento da Palavra de Jesus no Mundo de Hoje”

- 'I Love fruit & veg from Europe': Weihnachten in der Schweiz ist gesund und voller Aromen

- Fidupar Now Live on Framework’s Core Solution

- Maya Miranda Ambarsari launches InterconnectDATA information platform for authentic data

- Digi Communications N.V. Announces that the offer of the Company’s Romanian subsidiary was designated winner of the auction organised for the allocation of certain radio frecquency entitlements

- Cruzeiro Safaris Kenya Tour Operators Offers Guidance on Wildlife Africa Safaris to Kenya Booking and Experiences

- New dating site aimed at people with mental health problems launches in Switzerland

- BITSCore Tests Satellite Cyber-Security and Ride-Share Algorithms on Australian Rocket

- StatusMatch.com ed Emirates collaborano per aiutare i frequenti viaggiatori italiani a tornare in volo

- StatusMatch.com and Emirates partner up to help Italian frequent flyers get back in the air

- MinDCet drivers and FTEX powertrain solutions enable EV GaN applications

- Digi Communications NV announces the release of the Q3 2021 Financial Results

- Origami and citoQualis Team up for Startups

- Digi Communications NV announces Investors Call for the Q3 Financial Results presentation

- Digi Communications N.V. announces the extraordinary general meeting’s resolution from 4 November 2021, approving the appointment of KPMG N.V. as the Company’s statutory auditor for the 2021 financial year

- Digi Communications N.V. announces The solution reached by the Bucharest Court of Appeal regarding the investigation conducted by the Romanian National Anticorruption Directorate with respect to RCS & RDS S.A., Integrasoft S.R.L. and certain of their directors

- Digi Communications N.V. Announces the results of the auction organised by the Portuguese Authority for Telecommunications

- Haizol expands its capabilities to include component assembly and product development

- EIC, the World’s Largest Multinational Innovation Program, to Invest €13.4M in Wi-Charge, a Game Changing Wireless Power Company

- UNice Hair Debuts Brown Balayage Hair Bundles With Lace Closure

- European Weightlifting Federation on its way for Electoral Congress

- “Without women, We are unable to solve the world’s greatest challenges” — She Loves Tech 12 Hot Finalists ready to get their chance at the Local Pitch in South Europe!

- Significant improvement in increasing Time In Range and reducing hypoglycemia among people equipped with Diabeloop DBLG1

- Digi Communications N.V. Announces the Convocation of the Company’s Extraordinary General Meeting of Shareholders on 4 November 2021 in order to appoint KPMG N.V. as the Company’s new statutory auditor for the financial year 2021

- Unit of Measure enters partnership with Stibo Systems

- Haizol, metal manufacturing giant, launch a brand new website which is both user friendly and interactive

- Groundbreaking Immersive Experience from Samsung and Artist Michael Murphy Reveals a New Perspective for Visual Entertainment Through the Stunningly Slim Neo QLED TV

- Collaboration between Airbus and Neural Concept

- Archpriest Nikolay Balashov on Patriarch Bartholomew’s speeches in Kiev

- ABB's Peter Voser joins Xynteo's Europe Delivers partnership as it new Chairman

- Digi Communications NV announces that a new stock option programme was approved

- Leverage the benefits of digital manufacturing with Haizol

- Digi Communications NV announces the release of the H1 2021 Financial Results

- Digi Communications NV announces Investors Call on the Financial Results for H1 2021

- Rockegitarist-Sensasjon Rocky Kramer Har Fått Hovedrollen I Mutt Productions Filmen Rockin’ In Time

- Dispatch.d Offers Unique US Market Entry Services for European Impact Brands

- CSA Research’s New Localization Intelligence Analyzer, powered by LocHub, Helps Organizations Improve their Website’s Effectiveness for Global Customers

- Customer Data Platform Industry Accelerated During Pandemic: CDP Institute Report

- Digi Communications N.V. announces that two of its subsidiaries entered into two facility agreements

- Introducing Cap Expand Partners, Helping Business Leaders Break International Barriers

- Hong Kong’s Innovation and Technology Venture Fund Becomes Strategic Financial Investor of Ignatica

- Royal Caribbean Awards Handling Specialty its Largest Fixed Price Contract in 58-Year History

- Wildlife Safari Vacations in Kenya Travel with Cruzeiro Safaris Kenya Vacations in Kenya

- Cruzeiro Safaris Kenya offers the best Wildlife Safari Vacations

- Cure for prostate cancer on the horizon

- Fanpictor signs multi-year partnership with Royal Belgian Football Association

- Fanpictor unterzeichnet mehrjährige Partnerschaft mit dem Königlich Belgischen Fussballverband

- Fanpictor signe un partenariat pluriannuel avec la Royal Belgian Football Association

- Fanpictor firma una colaboración de varios años con la Real Federación Belga de Fútbol

- Fanpictor firma una partnership pluriennale con la Royal Belgian Football Association

- Fanpictor tekent meerjarige partnership met Koninklijke Belgische Voetbalbond

- Launch of the New Akenza Platform

- PayPerHead Set to Begin $3 Per Head Until Super Bowl Promo

- De zelflerende algoritme DBLG1®: eenvoudig te gebruiken voor een optimale en gepersonaliseerde behandeling van diabetes type 1

- Launch of the Anna Lindh Foundation Virtual Marathon for Dialogue!

- Digi Communications N.V. announces the exercise of stock options by the Executive Director of the Company pursuant to the decision of the Company’s general meeting of shareholders dated 30 April 2020 and in accordance with the stock option plan approved at the level of the Company in 2017

- New research unlocks long tail growth opportunity for the tech industry

- Digi Communications NV announces the availability of the instructions on the 2020 share dividend payment

- Digi Communications NV announces that conditional stock options were granted to several Directors of the Company based on the approval of the general meeting of shareholders from 18 May 2021

- Digi Communications N.V. Announces the Company’s General Shareholders Meeting resolutions adopted on 18 May 2021 approving, amongst others, the 2020 Annual Accounts

- PayPerHead Agents Ready for NBA & NHL Playoffs Revenue Boost

- Digi Communications N.V. (“Digi”) announces the Q1 2021 Financial results

- Are You Looking For A Powerful And Free Way To Increase Your Chess Rating

- Digi Communications NV announces Investors Call for the Q1 2021 Financial Results

- Digi Communications N.V. announces an Amendment to the 2021 Financial Calendar

- Fastpayhotels Hits an Industry Milestone by Connecting 500 Hotels Per Day Through DerbySoft Technology

- 4 ways to build a more flexible supply chain

- PayPerHead Agents Expect 2021 Triple Crown Revenue Bounce Back

- Join the world's leading virtual CBD event for FREE

- ITFX GROUP launched the ITGFX development strategy plan and entered the Asian market

- DEEPENING STRATEGIC RELATIONSHIP BETWEEN UBC AND PIONEERING DECENTRALISED PLATFORM, MANYONE

- Mono Solutions recognizes Norwegian small business agency with best website 2021 award

- Mono Solutions and Xrysos Odigos unlock new opportunities for small businesses

- Behind the scenes of a 10,000-people online conference: creating a live-event atmosphere and leveraging cybersecurity software

- Largest Supply Chain for Face masks, FFP2, FFP3 and cloth masks

- TRANSMAR AND TRANSMETRICS SIGN DEAL FOR STATE-OF-THE-ART LOGISTICS COLLABORATION

- 2021 NFL Draft Should Break 2020’s Record Betting Handle

- Amendment of Digi Communications N.V. Financial Calendar for 2021

- 4iG and Digi Communications NV’s Romanian subsidiary have entered into a term sheet with regards to a potential acquisition by 4iG of DIGI Group’s Hungarian operations

- “Building Healthy Relationships and Enhancing Gender Equality”: Young women from Cyprus, Egypt, Lebanon and Jordan come together

- Bring Ventures investit dans Crossborderit (CBIT), DDP et une solution de commerce électronique

- Bring Ventures investiert in Crossborderit (CBIT), eine DDP (geliefert verzollt) und E-Commerce Lösung

- Bring Ventures invests in Crossborderit (CBIT), DDP and ecommerce solution

- Bookies Expect the 2021 MLB Season to Drive Big Betting Action

- Lionspeed GP with Patrick Kolb and Lorenzo Rocco joins forces with CarCollection Motorsport in 2021

- Eurekos, ein klassenbester LMS-Anbieter, hat seine Position im renommierten Fosway 9-Grid™ für Lernsysteme verbessert

- Eurekos, en førsteklasses LMS-udbyder, har forstærket sin position på den prestigefyldte Fosway 9-Grid™ for læringssystemer

- Eurekos, ein erstklassiger LMS-Anbieter, hat seine Position auf dem renommierten Fosway 9-Grid™ für Lernsysteme weiter ausgebaut

- Digi Communications N.V. announces Share transaction made by an executive director of the Company with class B shares

- Digi Communications N.V.: Announces an Amendment to the Financial Calendar for 2021

- Ideanomics Invests $13M in Italian EV Motorcycle Company, Energica

- U.S. Bookies Starting to See Interest in Esports Rise Dramatically

- DigiSky and Asman Technology Announce Global Reseller Agreement

- Neowintech - O Marketplace Da Sua Próxima Solução Financeira

- Neowintech - Il Marketplace per la tua prossima soluzione finanziaria

- PIONEERING DECENTRALISED SECURE MESSAGING PLATFORM MANYONE ANNOUNCES STRATEGIC RELATIONSHIP WITH UNIVERSITY COLLEGE LONDON CENTRE BLOCKCHAIN TECHNOLOGY

- American Bookies See Soccer’s Popularity Rise

- Digi Communications NV announces the release of the 2020 Preliminary Financial Results

- Fraunhofer IGD develops automated robotic arm to scan cultural objects in 3D, now cooperating with Phase One

- Adapt Fast or Disappear – Choosing the Right Supplier

- Digi Communications NV announces Investors Call for the 2020 Preliminary Financial Results

- A URSAPHARM Arzneimittel e a CEBINA anunciam uma parceria com vista a reaproveitar o anti-histamínico azelastina para combater a COVID-19

- URSAPHARM Arzneimittel et CEBINA annoncent un partenariat pour reconvertir l'antihistaminique azélastine afin de lutter contre la COVID-19

- URSAPHARM Arzneimittel y CEBINA anuncian una colaboración para readaptar el antihistamínico azelastine para combatir la COVID-19

- URSAPHARM Arzneimittel and CEBINA announce partnership to repurpose the antihistamine azelastine to combat COVID-19

- ANIL UZUN Will Launch Bass Guitar Lessons Series on Youtube

- Henrik Stampe Appointed CEO for Mono Solutions

- Bookies are Ready for NCAA March Madness to Return

- Anna Mossberg leder Nordens största privata AI-lab i Sverige: "Utan AI riskerar svenska företag att förlora sin konkurrensfördel."

- What COVID-19 has taught us about manufacturing & the importance of a digital online marketplace

- Digi Communications N.V. announces: the Supreme Court of Hungary dismissed the Company’s appeal related to the 5G Tender procedure

- Customer Data Platform Industry to Reach $1.5 Billion in 2021: CDP Institute Report

- Bookies Expect Record-Breaking Super Bowl LV Action

- Donna Thomas Joins Visual Data Media Services as Senior Vice President of Sales, Americas

- Discover how business proposals almost write themselves with the use of Artificial Intelligence in a new update from Offorte.com

- Haizol, Where Buyers Meet Suppliers

- When Suffering From Endometriosis, The Natural Therapy Fuyan Pill Is A Useful Medicine For Pregnancy Plan Of Female

- Bookies Offering More NFL Playoff and Super Bowl Player Betting Options

- Digi Communications N.V. announces the publishing of the Financial Calendar for 2021

- Digi Communications NV announces: Final dismissal by the US Court of the claim brought by certain US citizens against all the initial defendants, including i-TV Digitális Távközlési Zrt

- EMMY WINNERS GIVE KUDOS TO THECGBROS CGINSIDER PODCAST

- Firebolt Group Joins Top 1% of Companies Recognized for Sustainability Efforts

- Electriq Global and GVG Oil Trade B.V. to partner in fuelling Passenger Canal Boats with Electriq Fuel

- Haizol Deliver Fast Lead Times & Quality Parts at speed in the lead up to Chinese New Year

- Digi Communications N.V. announces the conclusion a MVNO agreement between the Company’s Italian subsidiary (Digi Italy) and Vodafone regarding the access to Vodafone’s radio spectrum and mobile communication network and infrastructure

- Experts demand for more transparency for medical treatment of politicians

- SouthAfricanCasinos.co.za Negotiates Unbeatable No Deposit Bonus at Europa Casino for SA Players

- Electriq Global will launch its Zero Emissions, Hydrogen-Rich Fuel in the Netherlands by powering passenger canal boats with an Electriq PowerPack in compliance with the Amsterdam municipality requirement that all passenger vessels will be emission-free from 2025

- Spanish team wins the Farming by Satellite Prize 2020

- Digi Communications N.V. announces the senior facility agreement concluded between Digi Group and a syndicate of banks

- Sportsbooks Getting Ready for NFL Super Bowl LV

- Book your 2021 Wildlife Safari Vacations in Kenya with Cruzeiro Safaris

- Increase in Booking to Travel to Kenya for the year 2021 #RestartTourism with Cruzeiro Safaris Kenya to Wildlife Safari Vacations in Kenya

- Corma.de launches Social Links OSINT Academy

- No Negative COVID Effects on NFL Betting Action

- Stuck for That Perfect Adult Stocking Stuffer? Need a Mommy's Time Out After A Long Day At Home?

- Can Chinese save the world economy?

- Pleme social network has been building throughout the Pandemic

- Visual Data Media Services to Partner with Endeavour Capital for Next Phase of Growth

- Digi Communications NV announces the release of the Q3 2020 Financial Results

- PayPerHead Releases Premium Casino Platform

- Haizol Expand its Capabilities into Motorcycle Manufacturing & Custom Made Bike Parts

- Shrine - Book Of Heaven

- Digi Communications NV announces Investors Call on the Financial Results for Q3 2020

- Dutch Police selects bodycams from Zepcam to support police officers on the street

- Palette Life Sciences expands availability of online education and resources for paediatric urologists across Europe

- Sumitomo Corporation Europe Limited and NORCE Norwegian Research Centre AS sign Memorandum of Understanding

- Syniti & SAP Expand Partnership to Increase Client Options for Moving Harmoniously to SAP S/4HANA

- China’s manufacturing industry continues to expand according to the latest Purchasing Managers’ Index figures, with Haizol at the forefront of the growth

- AutoSock sono conformi alla regolamentazione Svizzera riguardante le catene da neve

- Introverts, nerds and geeks make the best salespeople

- It’s Time To Promote Civility In the United States

- Digi Communications NV announces the extension of the agreement entered into between the Company’s subsidiary from Spain (Digi Spain) and Telefonica Moviles España, S.A. regarding the access to TME’s radio spectrum and mobile communication network and infrastructure

- U.S. Presidential Election Wagering Heats Up

- Tiqets’ US Awakens Week Highlights Exclusive New Experiences From Newly Reopened Museums and Attractions

- Haizol Boosts Companies Operational Agility

- Eveliqure announces the initiation of a Phase 1 clinical study of its combined Shigella and ETEC vaccine candidate

- eFax führt das EMEA-Kanalprogramm ein

- eFax lance un programme de distribution dans la région EMEA

- Mono Solutions partners with Lokale Internetwerbung to launch in leadhub platform

- Syniti Launches Podcast Series to Address Growing Focus on Mergers, Acquisitions and Divestitures, featuring Leading CEOs

- This Year's NFL Season Could Be One For the Ages

- Mono Solutions and Ecwid partner for the seamless delivery of websites with e-commerce for small businesses

- Galata Chemicals to produce Tin Stabilizers and Intermediates at Dahej, India

- INFOCUS CORPORATION AND CELEXON EUROPE SIGN EXCLUSIVE EUROPEAN MASTER DISTRIBUTION AGREEMENT

- L’Awakening Week de Tiqets en France met en avant les nouvelles expériences exclusives de plus de 15 musées et attractions qui ont récemment rouvert

- Tiqets UK Awakens Celebrates Reopened Museums & Attractions and Sponsors Visits for NHS Staff

- Tiqets Awakening Weeks Brings Together 100+ Museums and Attractions to Celebrate Their Reopenings

- As NFL Season Draws Closer, Bookies Switch to New Software Providers

- A Jewish-Bedouin Partnership is bringing the Negev cuisine to Europe

- Digi Communications NV announces the release of the H1 2020 Financial Results

- New Chief Financial Officers appointed at Mono Solutions & Bauer Media Group SME Services

- Bookies Clamoring for Safe and Secure Ways to Collect and Get Paid from Players

- Digi Communications NV announces Investors Call on the Financial Results for H1 2020

- Palette Life Sciences AB and Gedeon Richter Plc. Receive National Marketing Authorization in the United Kingdom for Novel Pain Relief Product, LIDBREE™

- Palette Life Sciences launches Deflux.com/UK, an online resource for paediatric urologists, parents and caregivers in the United Kingdom

- Billionaire Richard Branson Called a Trademark Bully by the Trademark Law Professors of University of Washington, School of Law

- Digi Communications N.V. announces the publishing of Independent Limited Assurance Report issued by the external auditor of the Company on 30 July 2020 regarding the information included in the current reports issued by the Company under Law 24/2017 (Article 82) and FSA Regulation no. 5/2018

- The Pavilions Hotels & Resorts Excited To Announce First Luxury Resort Brand In El Nido, Palawan Island Philippines

- RCH Group Cements its International Reach

- New Customer Data Platform Options Emerge During Pandemic Slowdown: CDP Institute Report

- Digi Communications N.V. announces The Competition Council authorized the economic concentration accomplished by the Company’s Romanian subsidiary („RCS&RDS”) by gaining control over some of the assets held by Akta Telecom S.A., Digital Cable Systems S.A. and ATTP Telecommunications S.R.L.

- TABS Score™ Expands its European Footprint; Begins Partnership Discussions Amongst Key Players in EU Venture Ecosystem

- Virgin’s unethical business practices against small start ups and non-profit foundations

- Mono and Brandify partner to bring appointment booking to local businesses

- While major games dropped cases because of social separating conventions, sportsbooks are discovering approaches to keep players inside the action during this pandemic

- Digi Communications N.V. announces ANCOM approval for RCS & RDS S.A. to continue to apply a surcharge for certain roaming services provided in the EEA for a renewed maximum period of 12 months

- DerbySoft Expands Metasearch Coverage for Hotels Around the World

- Palette Life Sciences Announces European Distribution Expansion for Deflux® and Solesta® for More Than Twenty Countries Through Five Leading Distributors and Direct Sales Effort

- Pierre Koukjian and Cedric Koukjian, Designer Duo in Collaboration with Bulgari

- Pierre Koukjian et Cédric Koukjian, Duo de designers en collaboration avec Bulgari

- PayPerHead Agents See Huge Uptick in Online Casino Gaming

- Virgin hires private investigators to spy and find out where VIRGINIC employees live in the US. VIRGINIC wins with Virgin twice in the UK

- Former Duff & Phelps EMEA Leader Yann Magnan joins 73 Strings as Co-founder and CEO

- Concern for the oceans drives consumers to 'vote with their forks' for sustainable seafood

- Digi Communications N.V.: Exercise of stock option by Marius Catalin Vărzaru, a Non-Executive Director and VP of the Board of Directors of the Company

- USBLockit.com releases Free App to “Password Protect the USB Flash Drive” for Android

- VIRGINIC defends its case and stands up to Virgin after attack on Linkedin profiles of shocked VIRGINIC employees

- SecurLine Certified to Protect Classified Communications

- Digi Communications N.V. announces that a stock option programme was approved for employees and managers of the Romanian Subsidiary of the Company

- Digi Communications NV announces the exercise of stock options by the Executive Directors of the Company

- Matvil Corp. Continues Its Fight Against Illegal Actions of the Legal System of Moldova

- Matvil Corp. продолжает бороться с противозаконными действиями юридической системы Молдовы

- Digi Communications NV announces the release of the Q1 2020 Financial Results

- Digi Communications NV announces that conditional stock options were granted to several Directors of the Company based on the general shareholders’ meeting approval from 30 April 2020

- PayPerHead® Sportsbook Software Helps Online Bookies Stay in Business

- MEDIS medical imaging systems acquires Advanced Medical Imaging Development S.r.l. (AMID) and secures further investment from Van Herk Ventures

- Digi Communications NV announces Investors Call on the Financial Results for Q1 2020

- Digi Communications N.V. announces the availability of the instructions on the 2019 share dividend payment

- Mono Solutions hires Chief Product Officer

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 27 – 30 Apr 2020

- Despite No Sports, PayPerHead® Keeps Players In Action

- Digi Communications N.V.: GSM resolutions from 30 Apr 2020 approving, amongst others, the 2019 Annual Accounts; availability of the adopted Annual Financial Report for the year ended Dec 31, 2019 for the Group

- RCH Embark on Lasting Partnership with Culinary Institute JRE

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 20 – 24 Apr 2020

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 13 – 17 Apr 2020

- PayPerHead® Steps Up To Help Small Business Owners

- COVID-19: Digi Communications N.V. recommendation regarding participation of shareholders to the AGM convened for 30 April 2020

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 6 – 10 Apr 2020

- DIGI COMMUNICATIONS N.V.: Exercise of stock option by a Non-Executive Director of the Company

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 30 Mar – 3 Apr 2020

- Chief Commercial Officer joins Mono Solutions

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 23 – 27 Mar 2020

- Digi Communications N.V. reports the admission to trading on the regulated market operated by the Irish Stock Exchange plc (trading as Euronext Dublin) of the senior secured notes issued by RCS & RDS S.A., its Romanian subsidiary

- Delft University of Technology Purchases its Second WebClip2Go Video Production System

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 16 – 20 Mar 2020

- Integrated Services Monitoring Capability Launched by Bridge Technologies

- Digi Communications N.V. announces Convocation of the Company’s general shareholders meeting for 30 April 2020 for the approval of, among others, the 2019 Annual Report and of the 2019 Financial Statements

- Digi Communications N.V. announces The Hungarian Competition Council’s decision to issue a new decision approving the Invitel transaction

- Digi Communications N.V. announces Business continuity in light of the novel coronavirus (“COVID-19”) outbreak

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 9 – 13 Mar 2020

- Reporting of legal documents concluded by DIGI Communications N.V. in February 2020 or in other period but effective in February 2020, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 2 – 6 Mar 2020

- « La levée du pilon sur la plate-forme » peut faire la différence entre le saint et l’ordinaire

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 24 – 28 Feb 2020

- EH GROUP ENGINEERING awarded EU Horizon 2020

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 17 – 21 Feb 2020

- Digi Communications NV announces the release of the Preliminary Financial Results for year ended 31 December 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 10 – 14 Feb 2020

- Reporting of legal documents concluded by DIGI Communications N.V. in January 2020 or in other period but effective in January 2020, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Digi Communications NV announces Investor Call on the Preliminary Financial Results for the year ended 31 December 2019

- Consolidation Looms for Fast-Growing Customer Data Platform Industry: CDP Institute Report

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 3–7 Feb 2020

- Digi Communications N.V. hereby reports successful closing of the offering of senior secured notes by RCS & RDS S.A., its Romanian subsidiary

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 27 – 31 Jan 2020

- Digi Communications N.V.: Independent Limited Assurance Report issued by the external auditor on 30 Jan 2020 regarding the information included in the current reports under Law 24/2017 (Article 82) and FSA Regulation no. 5/2018

- Digi Communications N.V.: Rectification of the report published on 15 Jan 2020, regarding legal documents concluded by DIGI COMMUNICATIONS N.V. in other periods but effective in Dec 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Digi Communications N.V. reports the upsize and successful pricing of the offering of senior secured notes by RCS & RDS S.A., its Romanian subsidiary

- RCH To Present New Smart ECR, Robust and Vintage POS Systems at EuroShop 2020

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 20 – 24 Jan 2020

- Digi Communications N.V.: (i) launch of an offering by RCS & RDS S.A. of senior secured notes; (ii) issuance of a notice of conditional full redemption of all outstanding €550.0m 5.0% senior secured notes due 2023 issued by the Company and (iii) restatement by the Company of its unaudited interim condensed consolidated financial statements for the 9-month period ended 30 Sep 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 13 – 17 Jan 2020

- Reporting of legal documents concluded by DIGI Communications N.V. in December 2019 or in other period but effective in December 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 6 – 10 Jan 2020

- SuitePad Announced as the Best Guest Room Tablet in the 2020 HotelTechAwards

- Wildlife Safari Vacations in Kenya Travel with Cruzeiro Safaris Kenya

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 30 Dec 2019 – 3 Jan 2020

- Axiom Prepaid Holdings Caps Off Banner Year with a Prestigious Accolade for Its CEO

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 23 and 27 December 2019

- Digi Communications N.V. Announces the publishing of the Financial Calendar for 2020

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol 16-20 Dec 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 9-13 Dec 2019

- Reporting of legal documents concluded by DIGI Communications N.V. in November 2019 or in other period but effective in November 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- American Hemp Processing To Roll Out Mobile Extraction Units

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 2-6 Dec 2019

- Menschenrechtsverletzungen durch Zwangskonvertierungen – Ein internationales Problem

- XPAND has launched “XPAND Code Generator”, a website that automatically issues XPAND Code that can be read from 200 meters/700 feet

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 25-29 Nov 2019

- RCS & RDS S.A., Digi Communications N.V.’s subsidiary in Romania, entered into agreements to operate the telecommunications networks of the Romanian companies Digital Cable Systems S.A., AKTA Telecom S.A. and ATTP Telecommunications S.R.L

- Crafting qualifications to accelerate adoption of Additive Manufacturing

- 100,000 Graduation Ceremony of Shincheonji Theology Center Held over 112 countries

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 18 – 22 Nov 2019

- PDA GMP for APIs Education Webinar Now an "ICH Recognised Training Programme"

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 11 – 15 Nov 2019

- Reporting of legal documents concluded by DIGI Communications N.V. in October 2019 or in other period but effective in October 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Digi Communications NV announces the release of the Q3 2019 Financial Results

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 4 – 8 Nov 2019

- Digi Communications NV announces Investor Call on the Financial Results for Q3 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 28 Oct – 1 Nov 2019

- Medis to Launch an Innovative 4D Flow Module for Clinical Practice

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 21-25 Oct 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 14-18 Oct 2019

- Reporting of legal documents concluded by DIGI Communications N.V. in September 2019 or in other period but effective in September 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 7-11 Oct 2019

- RCH to Launch WALLE 8T POS for Real-time Access to Data in the Cloud

- ASI Drives Launches Mark 600, Poised to Replace Internal Combustion Engines

- Now The Cash For Gold Is Reliable Old Gold Jewelry Buyers

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 30 Sep – 4 Oct 2019

- Il noto Brand di Prodotti Promozionali Personalizzati National Pen lancia il Nuovo Sito Italiano

- Un nouveau look pour Universal Pen relançant son site Web de produits de marque promotionnels

- First non-melanoma skin cancer patients treated with the Rhenium-SCT® in Germany

- Finalyse welcomes Dublin as a new entity to the Group

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 23-27 September 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 16-20 Sep 2019

- VIAJES: LOS 5 DESTINOS MÁS BARATOS PARA ESCAPADAS URBANAS

- TRAVEL NEWS: Malaga tops the list of best value city break destinations in Spain

- Dr. Kurt Lauk, prominent business leader, former chairman of Economic Council in Germany (Wirtschaftsrat), former advisor to Angela Merkel, joins Tachyum

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 9-13 Sep 2019

- DIGI Communications N.V.: Decision regarding the participation to the auction procedure related to wireless broadband services supporting the introduction of 5G in Hungary

- Reporting of legal documents concluded by DIGI Communications N.V. in August 2019 or in other period but effective in August 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Fight To Fame Expands Its Search for the Next Action Film Star to Europe

- Digi Communications N.V. Announces the availability of Investor’s presentation on the company’s website

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 19 – 23 August 2019

- All occasion personalised pens produced by specialist company Camaloon

- Nicht nur für Messen: Werbemittel Kugelschreiber

- Stylos personnalisés : Camaloon pense à tout

- Camaloon: una Penna da personalizzare per ogni occasione

- Experterna på tryck erbjuder profilerande bläckpennor för varje tillfälle

- Gepersonaliseerde pennen kiezen voor al uw behoeften

- MÁS DE 20 MILLONES DE PRODUCTOS DE PAPELERÍA SON COMPRADOS CADA DÍA

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 12 -16 August 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 12 -16 August 2019

- XPAND K.K. will exhibit at the IFA 2019 as a Japanese cutting-edge IT company

- Reporting of legal documents concluded by DIGI Communications N.V. in July 2019 or in other period but effective in July 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018

- Digi Communications N.V. Announces the availability of H1 2019 Financial Report (for the six month period ended 30 June 2019)

- PDA Announces Six Regulatory Authorities Speaking at Biomanufacturing in Munich

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 5 and 9 August 2019

- Digi Communications NV Announces Investor Call on the Financial Results for the Half-year ended 30 June 2019

- Customer Data Platform Industry Grew 71% in One Year; Will Reach $1 Billion Revenue in 2019

- Central European Online Travel Agency Group Szallas.hu PLC. further strengthens its international presence

- With The Lure Of High Threadcount Sheets After A Day Trekking, Luxury Travel Blogger THE BOUTIQUE ADVENTURER Champions Chic Solo Explorations

- Digi Communications N.V. announces Syndicated facility agreement concluded between the Digi Group and a syndicate of banks

- LA SCULPTURE DE CEDRIC KOUKJIAN, « LIAISON », SERA EXPOSÉ EN PUBLIC PAR LA COMMISSION CULTURELLE DE COLOGNY, EN SUISSE

- CEDRIC KOUKJIAN’S SCULPTURE, “LIAISON” TO BE EXHIBITED IN PUBLIC BY CULTURAL COMMISSION OF COLOGNY IN SWITZERLAND

- Digi Communications N.V.: Independent Limited Assurance Report issued by the external auditor regarding the information included in the current reports under Law 24/2017 (Article 82) and FSA Regulation no. 5/2018

- Il 18° tour del lago Qinghai si conclude con la celebrazione della "maggiore età"

- La 18ª Vuelta al Lago Qinghai concluye con la celebración de su “mayoría de edad”

- 18e ‘Tour of Qinghai Lake’ wordt afgesloten met een ‘coming-of-age’-viering

- Digi Communications N.V.: Rectification of reports published on 15 Feb, 15 Mar, 15 Apr, 15 May and 14 Jun 2019 regarding legal documents in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018 published

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 22 and 26 July 2019

- GEANGO at ENSO ANGO - Summer Culture Retreat in Kyoto 2019

- DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol (15-19 July 2019)

- Nanto Cleantech Inc victorious in BYK-Altana patent opposition lawsuit

- Mono Solutions Joins Bauer Media Group to Strengthen SME Marketing Services Across the Globe

- UK Investors File Lawsuit in the Canaries Against Blue Explorers for Misleading Shareholders

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 8 – 12 July 2019

- Digi Communications N.V. announces Share transaction made by an executive director of the Company with class B shares on 11 July 2019

- OFERTA de casas vacacionales de lujo para menos de €25 por persona por noche este verano

- Noticias de Turismo: este verano sacarás más partido de tu presupuesto vacacional encontrando precios más competitivos

- TRAVEL NEWS: Your holiday spending money stretches even further this summer in Spain

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 1 – 5 July 2019, under the class B shares buy-back program approved by the GSM from 30 April 2019 and the duration of this program

- Global Software Innovator, AnyDesk, Announces Record 100 Million Downloads

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 24 and 28 June 2019

- Digi Communications N.V. announces the launch by RCS & RDS S.A., its subsidiary in Romania, of the Digi Mobil 5G Smart service

- Tauschen Sie Ihren Dripper aus und verändern Sie den Geschmack Ihres Kaffees! HARIO veröffentlicht den Double Mesh Metal Dripper.

- Change your dripper and change the flavor of your coffee! HARIO launches the Double Mesh Metal Dripper

- Matvil Corp. противостоит беспределу судебных властей Молдовы

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 17 – 21 June 2019

- Matvil Corp. Fights the Illegal Actions of the Legal System of Moldova

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 10 and 14 June 2019

- Digi Communications N.V.: Reporting of legal documents concluded by the company in May 2019 in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018 published

- DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions occurred under DIGI symbol between 3 – 7 June 2019

- PDA Explores the Transformation of Healthcare at 4th Annual European Meeting

- ASI President John Cross Named AGMA Chairman

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 27 – 31 May 2019

- Breakthrough on laser powder bed fusion technology brings effective production of larger componentscloser to mainstream

- PDA Announces All-Star Speaker Lineup for Advanced Therapy Medicinal Products Conference

- Digi Communications N.V.: Exercise of stock options by the Executive Directors of the Company

- Digi Communications N.V. announces DIGI Kft., the Hungarian subsidiary of the Company, launches mobile telephony services in Hungary

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 21 and 24 May 2019

- ZYXEL READY WITH 5G SAMPLES IN AUGUST 2019

- Digi Communications N.V. announces the initiation of the share buy-back program as authorized by the Company’s GSM on 30 April 2019

- Digi Communications N.V Q1 2019 Financial Report and the report regarding legal documents for April 2019, in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018 released

- Digi Communications N.V. announces the new date of the Conference Call for the presentation of the Q1 2019 Financial Report. Update to the Company’s 2019 Financial Calendar.

- Rhenium-SCT® (SCT= Skin Cancer Therapy) now being offered in Hanau, Germany

- Project consortium aims at driving the adoption of selective laser melting (SLM) for large scale metal parts printing

- Digi Communications N.V. announces the availability of the instructions on the 2018 share dividend payment

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 29 April 2019 – 1 May 2019, under the class B shares buy-back program

- Biodiversity Report Is Urgent Call to Action Beyond Fixes; Geneva Global Initiative Calls on World Community to Focus on Concrete Actions

- Digi Communications N.V.’s general Shareholders’ meeting resolutions from 30 Apr 2019 approving, amongst others, the 2018 Annual Accounts and the availability of the adopted Annual Financial Report for the year ended Dec 31, 2018

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions occurred under DIGI symbol, 22 – 26 April 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 15 April 2019 – 19 April 2019s

- XPAND Code was successfully scanned from 200 meters/700 feet at Olympics stadium

- Wasser eingießen, Warten und Einschalten

- Digi Communications N.V.: Reporting of legal documents concluded by the company in March 2019 in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018 published

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 8 and 12 April 2019

- Snowman releases new EP

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 1 – 5 April 2019

- Streamlining adoption of high-speed and high-resolution surface texturing delivered with the Prometheus project

- Customer Data Platform Institute Launches RealCDP to Reduce CDP Confusion

- ASI Technologies Focuses on the future as ASI Drives, and New AGV Pallet Robot, FRED2500

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 25 March 2019 – 29 March 2019

- Towards a Europe of Stakeholder Nations

- Associazione Veneta Lotta alla Talassemia (AVLT) and the UK Thalassaemia Society (UKTS) Clarification on European Regulatory Status of LENTIGLOBIN™

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 19 March 2019 – 22 March 2019

- A new flagship project on Additive Manufacturing skills aims to maintain Europe leading position in industrial competitiveness

- Consultancy Partnership Revolutionizes Agile Project Management

- Jeroen Schouten Named Regional Manager, Europe of AeroGo, Inc.

- Digi Communications N.V. Convocation of the Company’s general shareholders meeting for 30 April 2019 for the approval of, among others, the 2018 Annual Report and of the 2018 Financial Statements

- España arrasa con la competencia y es nombrado como el país ideal para estudiar en el extranjero

- Xverify targets European Email Verification market with local data processing, Dublin office

- Digi Communications N.V. announces the resignation by Mr. Sambor Ryszka from his position as non-executive director of the Company

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 11 and 15 March 2019

- Digi Communications N.V.: Reporting of legal documents concluded by the company in February 2019 in accordance with article 82 of Law no. 24/2017 and FSA Regulation no. 5/2018 published

- New Services Larry Hurt income Tax Services

- Admission of Digi Communications N.V. €200,000,000 5.0% additional senior secured notes due 2023 to the listing on the Official List and trading on Irish Stock Exchange’s Main Securities Market

- Digi Communications N.V. announces the appointment of Dan Ioniță as a non-executive director of RCS & RDS S.A., the Romanian subsidiary of the Company

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 4 and 8 March 2019

- Digi Communications N.V. announces share transaction made by an executive director of the Company with class B shares on 4 march 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 25 February – 1 March 2019

- Digi Communications N.V. announces share transaction made by an executive director of the Company with class B shares on 1 march 2019

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 18 and 22 February 2019

- Digi Communications N.V.: finalization and registration by the Company of the conversion of 1,200,000 A shares into an equal number of class B shares

- Digi Communications N.V.: Exercise of stock options by a PDMR in accordance with the stock option plan for the Group’s Romanian employees

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 11 and 15 February 2019

- Dearly Beloved, The Latest Single By Alternative Urbane Artist Expands Up-And-Coming ADN Lewis's Global Fan Base

- Report of legal documents concluded by DIGI Communications N.V. in January 2019 or in other period but effective in January 2019

- Digi Communications N.V. announces Availability of Preliminary Financial Report for the year ended December 31, 2018 for Digi Communications N.V. Group

- Mono Solutions launches a new interface to drive the ultimate do-it-with-me (DIWM) experience

- Digi Communications NV Announces Investor Call on the Preliminary Financial Results for the year ended 31 December 2018

- Digi Communications NV: New date of the Conference Call for the 2018 Preliminary financial results; Update to the 2019 Company’s Financial Calendar

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 4 and 8 February 2019

- R.W. Chelsea Holdings Ltd Starts To Hold Fixed Income Investor Meetings In Vienna, Zurich, Geneva and London

- Digi Communications N.V. successfully increased and priced its Offering at €200,000,000 5.0% additional senior secured notes due 2023

- Digi Communications N.V. to offer additional €125,000,000 5.0% senior secured notes due 2023; new notes will be consolidated and treated as its existing €350,000,000; adjustment on interim unaudited consolidated financial statements for the nine-month period ending September 30, 2018

- World's largest superhero statue to be built in Central Europe

- The resignation of Mr. Bendei Ioan – VP and executive director of RCS&RDS S.A., DIGI COMMUNICATIONS N.V.’s subsidiary in Romania

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol between 28 January 2019 – 1 February 2019

- RCH Group to Showcase Integrated Selling Solutions at EuroCIS

- Mono and bfound partner to expand digital offerings for small businesses in the Middle East

- Digi Communications N.V. publishes the Independent Limited Assurance Report in accordance with Law 24/2017 (Article 82) and FSA Regulation no. 5/2018

- ERRATA of the reports dated 15 Jan 2019 and 15 Oct 2018 regarding the legal acts concluded by DIGI Communications N.V. in Dec 2018 and Sep 2018

- REVEALED: Experts reveal the best dates to book your summer holiday in Spain

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 21 – 25 January 2019

- Céline Dion visite son premier concept store de vêtements CELINUNUNU à Paris

- Anytime, anywhere tailored learning opportunities for welding professionals and apprentices alike

- i5invest открива офис в България

- Notification shares buy-back: DIGI COMMUNICATIONS N.V. reports to the regulated market the transactions which occurred under the DIGI symbol, 14 - 18 January 2019

- Mono helps Fonecta strengthen their digital presence offering for SMBs

- The Bucharest Tribunal’s decision regarding the investigation conducted by the Romanian National Anti-corruption Directorate with respect to RCS & RDS S.A., Integrasoft S.R.L. and certain of their directors

- Digi Communications N.V.: Exercise of stock options by a PDMR in accordance with the stock option plan approved by the Company for the Romanian employees of the Group in 2017

- Report of legal acts concluded by DIGI Communications N.V. in accordance with Romanian Law no. 24/2017 and FSA Regulation no. 5/2018 for December 2018

- Digi Communications N.V.: resolution of the Board of Directors to convert class 1,200,000 A shares into an equal number of class B shares for the purpose of the ongoing employees and directors stock option plans

- CELINUNUNU OUVRE SON PREMIER POP-UP À PARIS