Payroll Outsourcing Services Sourcing and Procurement Intelligence Report 2030

Payroll Outsourcing Services Category Overview

The global payroll outsourcing services category is anticipated to witness growth at a CAGR of 7.32% from 2023 to 2030. In 2022, North America held substantial share in global category, followed by Asia Pacific and Europe. Asia Pacific is speculated to witness the fastest CAGR over the projected timeframe. Big data, business analytics, automated subprocesses, and the introduction of cloud delivery models by the governments of various nations are all the factors contributing to this growth. Majority of businesses in the region rely on the services offered in the category because it allows for data access from any location at any time, on any device. Various organizations use these services to automate processes, reduce errors, and improve accuracy. China dominates the region as its economy offers a strong incentive for outsourcing with cost-saving being the main priority.

Based on end-user sector, the category is anticipated to witness notable growth in the consumer & industrial products sector. This prediction is the result of multiple factors. A wide range of businesses, including retail, e-commerce, and producers of consumer goods, are included in the consumer & industrial products sector. These businesses frequently have sizable workforces and intricate payroll requirements. By outsourcing their payroll services, they can concentrate on core business operations (such as innovation, customer support, and market expansion) while ensuring adherence to regulations pertaining to labor, and optimize payroll processing. In addition, the businesses can reclaim time and resources by outsourcing payroll to external specialists who can guarantee accuracy, compliance, and productivity, allocating them to initiatives that foster expansion and competitive advantage.

Order your copy of the Payroll Outsourcing Services Procurement Intelligence Report, 2023 – 2030 , published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Although the category is led by cloud-based solutions in terms of technology, other solutions such as artificial intelligence (AI) and machine learning (MI) have a key role to play. The application of AI & ML in payroll is rapidly expanding and has the potential to completely transform the way payroll is managed. Advanced AI and ML can enable HR personnels to discover abnormalities that affect the bottom line and gain insights into workforce efficacy with the help of more precise payroll classification of employees. Another important aspect of this technology is automation. Businesses are using AI to optimize routine operations like tracking labor hours and calculating salaries. In addition, AI can be used to improve early wage access, a feature that is frequently included in payroll systems. Employers can gain important insights into how their staff members use this function by having AI analyze data on scheduling patterns, overtime, pay cycle, salary, and frequency of use.

The COVID-19 pandemic benefited global payroll outsourcing service category since more businesses were operating remotely, making it challenging for HR and payroll professionals to complete payroll-related compliance activities. As a result, the majority of businesses turned their attention towards payroll outsourcing providers to manage their payroll-related tasks. In addition, because of the increased risk of virus transmission, outsourcing of the services offered in the category significantly decreased the necessity to have in-person payroll-related interactions between employers and employees. The pandemic brought to light the benefits of outsourcing payroll processes as a dependable and effective way for companies to stay accurate and on schedule while concentrating on their core competencies and promptly adapting to changing conditions. Consequently, the pandemic contributed positively to the category’s growth.

Payroll Outsourcing Services Sourcing Intelligence Highlights

- The payroll outsourcing services category exhibits a fragmented landscape, with the presence of large number of global and regional market players.

- Buyers in the category possess high negotiating capability owing to the intense competition among the service providers based on number of services and prices, enabling the buyers with flexibility to switch to a better alternative.

- India is the preferred low-cost/best cost country for sourcing payroll outsourcing services owing to competitive labor costs, which result in significant cost savings. In addition, the nation places strong emphasis on implementing the latest infrastructure and technologies.

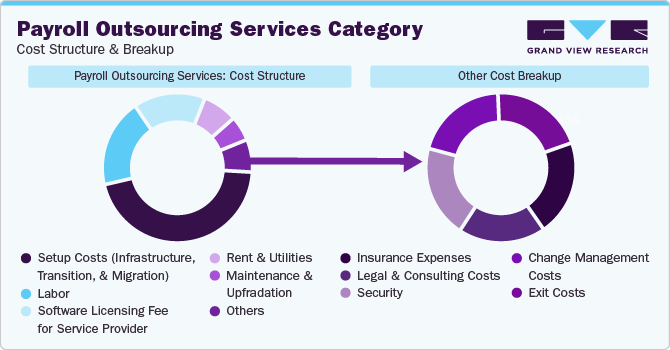

- Setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent & utilities, and maintenance & upgradation are the major cost components of payroll outsourcing services category.

Payroll Outsourcing Services Procurement Intelligence Report Scope

The Payroll Outsourcing Services category is expected to have pricing growth outlook of 5% – 10% increase (Annually) from 2023 to 2030, with below pricing models.

- Fixed pricing,

- per frequency pricing

Supplier Selection Scope of Report

- Cost and pricing,

- past engagements,

- productivity,

- geographical presence

Supplier Selection Criteria of Report

- Industries served,

- years in service,

- geographic service provision,

- revenue generated,

- employee strength,

- payroll processing (salary / wage),

- time & attendance management,

- tax management,

- self-service portal,

- recordkeeping & reporting,

- regulatory compliance,

- others

Payroll Outsourcing Services Procurement Intelligence Report Coverage

Grand View Research will cover the following aspects in the report:

- Market Intelligence along with emerging technology and regulatory landscape

- Market estimates and forecasts from 2023 to 2030

- Growth opportunities, trends, and driver analysis

- Supply chain analysis, supplier analysis with supplier ranking and positioning matrix, supplier’s recent developments

- Porter’s 5 forces

- Pricing and cost analysis, price trends, commodity price forecasting, cost structures, pricing model analysis, supply and demand analysis

- Engagement and operating models, KPI, and SLA elements

- LCC/BCC analysis and negotiation strategies

- Peer benchmarking and product analysis

- Market report in PDF, Excel, and PPT and online dashboard versions

List of Key Suppliers

- ADP, Inc.

- Ceridian HCM, Inc.

- CGI Inc.

- CloudPay Inc.

- Deloitte Touche Tohmatsu Limited

- Infosys Limited

- Intuit Inc.

- KPMG International Limited

- Paychex Inc.

- Ramco Systems Ltd.

- Workday, Inc.

- ZenPayroll, Inc. (d.b.a. Gusto)

Browse through Grand View Research’s collection of procurement intelligence studies:

- Call Center Service Procurement Intelligence Report, 2023 – 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Office Furniture Procurement Intelligence Report, 2024 – 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions