Quest CE Offers New Anti-Money Laundering and Red Flags Course

For 2009

Released

on: December 23, 2008, 2:30 pm

Press

Release Author: Alex Krenke

Industry:

Financial

Press

Release Summary: Quest CE offers a solution to new Red Flag Rules

and Anti-Money Laundering Training.

Press

Release Body: Milwaukee, WI December 23, 2008 -- Quest

CE announced today the release of their new 2009 Anti-Money

Laundering and Red Flags online course designed to meet USA Patriot

Act requirements. To demo the new course go to http://www.questce.com/AML-Course-Demo/Presentation_Files/index.html

The

USA PATRIOT Act requires financial institutions to develop and

implement an AML compliance program.

NASD

Rule 3011 outlines minimum standards for broker-dealers' AML compliance

programs. It requires firms to develop and implement a written

AML compliance program. The program has to be approved in writing

by a member of senior management and be reasonably designed to

achieve and monitor the ongoing compliance with the requirements

of the Bank Secrecy Act.

NASD

Rule 3011 also requires firms to provide ongoing training for

appropriate personnel. This would include training for all representatives

engaged in the business of providing financial advice, the sale

of financial products or services, or deal in any way with the

transfer of financial interests.

Quest

CE offers a complete Anti-Money Laundering (AML) solution

for organizations of all sizes. Quest’s Anti-Money Laundering

(AML) program offers advanced capabilities that other vendors

do not offer. In coordination with industry experts, Quest CE’s

team of IT and database professionals created a Learning Management

System (LMS) to fit the AML reporting, tracking, and training

needs of Quest’s clients.

“The

system allows AML program administrators the ability to run real-time

reports, upload new users instantly, and send reminder emails

to users who haven’t yet completed their training,”

said Patrick Torhorst, Vice President of IT for Quest

CE.

In

addition to offering this advanced technology in a fully customizable

web portal, Quest CE is offering the industry’s lowest available

pricing to companies interested in utilizing Quest’s AML

program. For as little as $2 per user, firms can have a web portal

built to look like their own AML eUniversity complete with full

reporting and tracking capabilities, and including Quest CE’s

robust library of Anti-Money Laundering (AML) courses.

Quest

CE can also author any firm’s proprietary courses

to meet specific training needs.

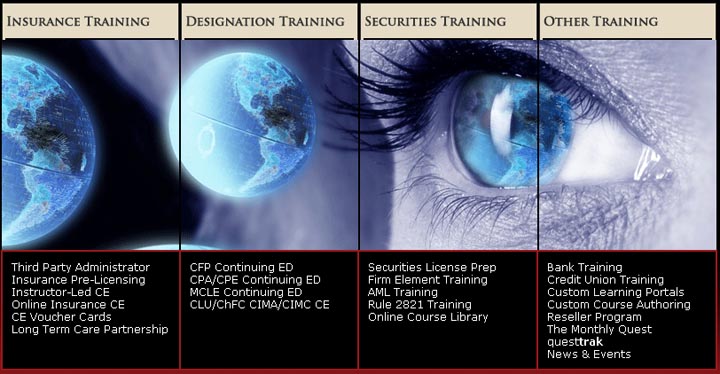

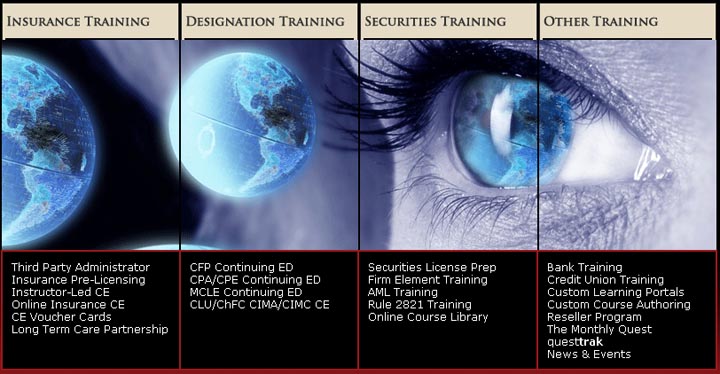

About

Quest CE

Over

the past 20-plus years, Quest CE has built a reputation of being

the premier provider of Compliance Solutions to the financial

services industry. In addition to offering CE for professionals

holding insurance licenses and professional designations like

the CFP, CIMA, CLU/ChFC, and CPA designations, we also provide

a complete spectrum of financial compliance training solutions.

Web

Site: http://www.questce.com

Contact

Details: 10850 W Park Place

Suite 1000

Milwaukee, WI 53224

http://www.questce.com/