Dietary Supplements Market 2030: The Impact of Aging Populations on Demand

Dietary Supplements Market Size & Trends

The global dietary supplements market size was valued at USD 177.50 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. Rising prevalence of chronic disorders, including obesity, diabetes, heart disease, and cancer, and the busy lifestyles and resultant changes in dietary patterns of consumers are among the key factors driving consumption worldwide. Manufacturers are continuously introducing novel products and formulations targeting specific consumer needs and preferences, such as weight management, sports nutrition, and brain health, among others. Consumers are increasingly made aware of such products and their benefits through effective marketing campaigns, influencer endorsements, and social commerce.

The aging population is an irreversible global trend that acts as a critical driving factor for market development. The global population over the age of 65 is a key demographic target for dietary supplement companies as they contribute extensively to the overall industry demand. Although the highest sales are witnessed in the adult category (people aged 25 to 65), penetration is significantly higher in the geriatric population set, with the latter contributing to roughly 30% of worldwide sales.

Gather more insights about the market drivers, restrains and growth of the Global Dietary Supplements Market

Ingredient Insights

Vitamin supplements accounted for a share of 30% of the global revenues in 2023. The growth of this category can be attributed to the growing consumer awareness regarding the nutritional gaps emerging because of busy lifestyles and improper dietary patterns. Consumers are increasingly accommodating vitamin products into their daily diets to ensure adequate nutrient consumption. Bone health (vitamin D) and brain health (Vitamin B) are notable examples of the major vitamin categories witnessing high demand worldwide.

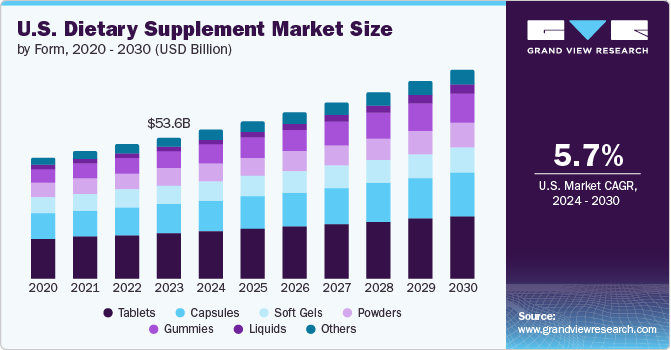

Form Insights

Tablets accounted for a revenue share of 32.3% in 2023. The growth of this category can be attributed to the convenience, portability, ease of ingestion, and extended shelf life on offer. Tablets provide precise and controlled doses of the active ingredients, thus ensuring consistent delivery per serving. Tablets are presently the most popular format for dietary supplements.

Application Insights

The energy and weight management segment accounted for a share of 30.3% in 2023. Sports enthusiasts mainly influence the demand for products that include vitamins and proteins. These products aid athletes in restoring their energy, bettering their muscular endurance, and minimizing body wear & tear. In addition, with the rising obesity rates and the growing focus on maintaining a healthy weight, several consumers are shifting to weight management products to complement their diets.

End-user Insights

Adults accounted for the largest share of 46.01% in 2023. The growing demand in this segment can be attributed to the increasing disposable incomes and the growing shift towards active and healthy lifestyle practices. The increasing awareness among working individuals and sports athletes regarding the nutritional gaps in their diets is expected to promote market growth during the forecast period.

Type Insights

Over the counter (OTC) products accounted for the largest revenue share of 75.5% in 2023. OTC sales are anticipated to witness steady growth over the coming years owing to the rising consumer awareness regarding the nutritional benefits of these products and the easy accessibility. Preventive healthcare practices are among the major factors driving the growth of this segment. The convenience of direct purchases and cost-effectiveness are expected to promote the sales of the OTC products during the forecast period.

Distribution Channel Insights

Offline sales of dietary supplements accounted for a revenue share of over 80% in 2023. The growing trend of medical practitioners treating gastrointestinal disorders, immunity-related issues, bone health, folic acid deficiencies, etc. with dietary supplements is expected to drive the segment growth. Sales through supermarkets & hypermarkets are also expected to grow at a CAGR of nearly 8.5% over the coming years, driven by the convenience and accessibility offered to consumers by these stores.

Regional Insights

North America accounted for a revenue share of 33% in 2023. Products targeting health & mental well-being have prompted the industry to increase R&D initiatives toward product innovation. Despite the uncertainties of existing regulations, outlining the context of a rapidly expanding market in the region. The industry is expected to grow on account of the changes in regulations, growing self-care movement, and overwhelming scientific evidence highlighting the critical link between diet and health.

Key Dietary Supplements Company Insights

Competition in the global dietary supplements market is characterized by a high number of product launches and acquisitions. Further consolidation and strategic developments are expected in the industry, driven by factors such as intense competition, changing consumer preferences, regulatory pressures, and the pursuit of growth and market dominance. These activities will likely continue to reshape the competitive landscape and influence the industry’s future dynamics.

Key Dietary Supplements Companies:

The following are the leading companies in the dietary supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Amway Corp.

- Abbott

- Bayer AG

- Glanbia plc

- Pfizer Inc.

- Archer Daniels Midland

- NU SKIN

- GlaxoSmithKline plc.

- Herbalife Nutrition Ltd.

- Nature’s Sunshine Products, Inc.

- XanGo, LLC

- RBK Nutraceuticals Pty Ltd

- American Health

- DuPont de Nemours, Inc.

- Good Health New Zealand

- Nature’s Bounty

- NOW Foods

Browse through Grand View Research’s Nutraceuticals & Functional Foods Industry Research Reports.

- U.S. Dietary Supplements Market Size, Share & Trends Analysis Report By Application-End User, By Application-Ingredient, By Form, By Type, By Distribution Channel, And Segment Forecasts, 2024 – 2030

- Omega 3 Supplements Market Size, Share & Trends Analysis Report By Source (Fish, Krill Oil), By Form (Soft Gels, Capsules), By End User (Adults, Infants), By Functionality, By Distribution Channel, And Segment Forecasts, 2020 – 2028

Dietary Supplements Market Segmentation

Grand View Research has segmented the global dietary supplements market based on ingredient, form, application, end user, type, distribution channel, and region:

Dietary Supplements Ingredient Outlook (Revenue, USD Billion; 2018 – 2030)

- Vitamins

- Botanicals

- Minerals

- Protein & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Probiotics

- Prebiotics & Postbiotics

- Others

Dietary Supplements Form Outlook (Revenue, USD Billion; 2018 – 2030)

- Tablets

- Capsules

- Soft gels

- Powders

- Gummies

- Liquids

- Others

Dietary Supplements Application Outlook (Revenue, USD Billion; 2018 – 2030)

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Lungs Detox/Cleanse

- Skin/ Hair/ Nails

- Sexual Health

- Brain/Mental Health

- Insomnia

- Menopause

- Anti-aging

- Prenatal Health

- Others

Dietary Supplements End User Outlook (Revenue, USD Billion; 2018 – 2030)

- Infants

- Children

- Adults

- Pregnant Women

- Geriatric

Dietary Supplements Type Outlook (Revenue, USD Billion; 2018 – 2030)

- OTC

- Prescribed

Dietary Supplements Distribution Channel Outlook (Revenue, USD Billion; 2018 – 2030)

- Online

- Offline

Dietary Supplements Regional Outlook (Revenue, USD Billion; 2018 – 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- Central and South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

Order a free sample PDF of the Dietary Supplements Market Intelligence Study, published by Grand View Research.

Recent Developments

- In September 2023, Kyowa Hakko, in collaboration with pharmaceutical manufacturer Quifaest, introduced its postbiotic ingredient, IMMUSE, to the Mexican market. This marks the first time IMMUSE has become available in Mexico, signifying a significant expansion of its global presence.

- In August 2023, Nutritional Research Company (NRC) announced the launch of its Absorbable range of supplements designed to support the immune system. This innovative product line includes three distinct offerings-Vitamin C, Vitamin D3 1000 IU, and Vitamin D3 2000 IU.

- In May 2023, Arla Foods Ingredients launched a solution that increases the protein level in oral nutritional supplements in juice-style drinks. These supplements are designed for convenience and easy consumption and are available in flavors like orange, mango, and strawberry.

- In April 2023, IFF introduced a vegan softgel capsule technology called Verdigel SC. This innovative solution, free from carrageenan, offers a plant-based alternative that seamlessly integrates into existing processes while ensuring the same level of manageability and stability as traditional vegan and animal-based soft gel methods.

- In April 2023, Ayana Bio introduced its plant cell-derived health and wellness ingredients, lemon balm and echinacea, marking a significant leap in addressing the challenges associated with traditional agriculture for these plants, including adulteration, contamination, pesticides, inconsistent quality, infection, weather fluctuations, and limited active metabolites.

- In February 2023, ADM, a prominent global leader specializing in science-backed nutritional solutions, inaugurated a state-of-the-art production facility in Valencia, Spain. This strategic move is aimed at satisfying the surging worldwide demand for probiotics, postbiotics, and related products that promote health and overall well-being.

- In February 2023, Kyowa Hakko’s IMMUSE, a postbiotic that supports the immune system, was incorporated into Comple.med’s new product, Lactoflor Immuno 200. This is the first product in Europe to feature IMMUSE. The formulation also includes Lactoferin and Vitamin D3. IMMUSE is a unique and patented postbiotic that activates plasmacytoid dendritic cells, activating other immune cells.

- In November 2022, the company partnered with TerraCycle, a recycling company, to divert its flexible packaging from landfills under its NOW Recycling Program. Consumers can collect 1 USD for every 1 pound of waste shipped to TerraCycle, which they can donate to a charitable, non-profit organization or school. The NOW Recycling Program enables the consumers to recycle flexible food and supplement packaging and toothpaste tubes that are not accepted by most municipal recycling programs.

- In February 2022, the company launched a new product line named Imaglow. The products are created in therapeutic doses to be especially beneficial for the skin, nails, and hair. They contain ingredients that aid in collagen absorption as well as provide increased antioxidant protection.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world’s most expansive market research database