Pet Insurance Market 2030: The Impact of Veterinary Advancements

Pet Insurance Market Size & Trends

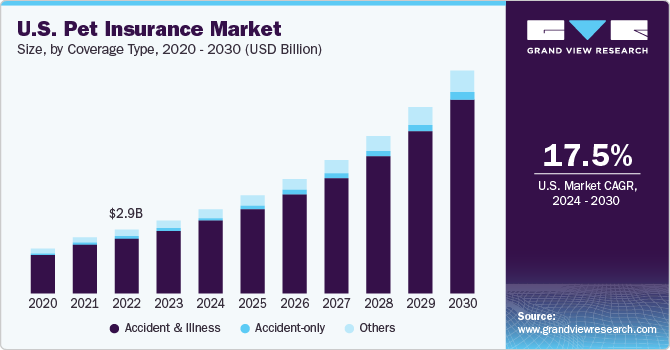

The global pet insurance market size was estimated at USD 11.87 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 14.15% from 2024 to 2030. The growing pet population, adoption of pet insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, and humanization of pets are some of the key factors driving the market growth. The latest findings from the 2023 State of the Industry (SOI) report by NAPHIA indicate that there are currently 5.36 million insured pets across North America. This represents a 21.7% increase compared to 2021 when the total number of insured pets in the area was 4.4 million. The rising incidence of diseases in cats & dogs and the increasing trend of pet adoption are expected to propel market growth.

In addition, there is a growing need for pet insurance to help mitigate expenses associated with serious medical conditions like accidental injuries and cancer, thereby fueling market expansion. The surge in demand for veterinary healthcare facilities is also expected to drive the adoption of pet insurance, as these services often involve significant capital investment, specialized personnel, and specialized diagnostic equipment, leading to higher treatment costs for pet owners. In addition, increasing disposable income of pet owners, especially in developing economies, has made pet insurance more affordable and accessible, driving market growth.

Gather more insights about the market drivers, restrains and growth of the Global Pet Insurance Market

Coverage Type Insights

By coverage type, the accident & illness segment dominated market with a share of 84.94% in 2023. It is also estimated to witness the fastest CAGR in the coming years. This growth can be attributed to several key factors, including the high costs associated with veterinary treatments and diagnostics, increasing population of companion animals, and a growing awareness of the importance of pet insurance. Accident and illness policies, which are typically offered by pet insurance companies, offer comprehensive coverage for a range of conditions, including acute and chronic diseases, medications, diagnostic tests, and more.

Animal Type Insights

By animal type, the dogs segment held the highest share of 59.47% in 2023. The other animal type segment includes horses, small mammals, etc., and is expected to grow at the fastest CAGR of more than 17% from 2024 to 2030. Key factors contributing to this share include growing pet adoption, expansion of service offerings by insurance companies, and growing disposable income in key markets. Some of the major players in this segment are Trupanion, Inc.; Petplan; PetFirst Healthcare LLC; Nationwide Mutual Insurance Company; and Embrace Pet Insurance Agency, LLC.

Sales Channel Insights

The direct sales channel segment held the highest share of 34.64% in 2023. The significant adoption of direct sales strategies by major pet insurance providers has been a driving factor. For example, Deutsche Familienversicherung AG noted that direct sales accounted for 8% of its new business during 2023, representing a substantial increase compared to the previous year. In addition, the company reported a notable 21.4% surge in online sales during the same period.

Regional Insights

In North America, the market held the second-largest revenue share in 2023. In 2022, around 5.36 million pets in North America had insurance, which increased by about 22%, according to The North American Pet Health Insurance Association (NAPHIA). With an increasing number of pet owners opting for insurance coverage for their pets, the market is expected to continue growing. However, the introduction of new insurance products by new and large-scale market entrants is expected to increase market competition in the region. The market is projected to mature over time with increased competition and volume of claims being processed.

Key Pet Insurance Company Insights

Some key players operating in this market include Trupanion, Inc., Direct Line, Nationwide Mutual Insurance Company, MetLife Services and Solutions, LLC.

Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Animal Friends Insurance Services Limited, and Figo Pet Insurance, LLC are some of the emerging market participants in the pet insurance market.

Browse through Grand View Research’s Animal Health Industry Research Reports.

- Pet Dental Health Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Type (Products, Services), By Indication (Gum Diseases, Endodontic Disease), By Distribution Channel, By Region, And Segment Forecasts, 2024 – 2030

- CBD Pet Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Indication (Joint Pain, Anxiety/Stress, Epilepsy), By Distribution Channel (Pet Specialty Stores, E-commerce, CBD Store), By Region, And Segment Forecasts, 2024 – 2030

Key Pet Insurance Companies:

The following are the leading companies in the pet insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Pet Insurance Market Segmentation

Grand View Research has segmented the global pet insurance market on the basis of coverage type, animal type, sales channel, and region:

Pet Insurance Coverage Type Outlook (Revenue, USD Million, 2018 – 2030)

- Accident & Illness

- Accident only

- Others

Pet Insurance Animal Type Outlook (Revenue, USD Million, 2018 – 2030)

- Dogs

- Cats

- Others

Pet Insurance Sales Channel Outlook (Revenue, USD Million, 2018 – 2030)

- Agency

- Broker

- Direct

- Bancassurance

- Others

Pet Insurance Regional Outlook (Revenue, USD Million, 2018 – 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Sweden

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- Israel

Order a free sample PDF of the Pet Insurance Market Intelligence Study, published by Grand View Research.

Recent Developments

- In January 2024, Five Sigma, a leader in cloud-based claims management solutions, formed a strategic alliance with Odie Pet Insurance, a company dedicated to making pet insurance more accessible and affordable. This partnership aims to revolutionize pet insurance claims processes and improve industry operations

- In November 2023, Fetch formed a partnership with Best Friends Animal Society, a national organization committed to ending the euthanasia of dogs and cats in American shelters by 2025. As part of this collaboration, Fetch will make substantial donations to support Best Friends’ efforts to rehome shelter pets and achieve their goal of making the country a no-kill nation

- In September 2023, Independence Pet Group (IPG), a prominent pet insurance platform offering comprehensive services, acquired Felix, the sole pet insurance brand exclusively catering to cats in the U.S.

- In August 2023, Global Risk Partners (GRP) entered the pet insurance market in the UK by acquiring Petsmedicover, a pet insurance broker trading as VetsMediCover. Following the acquisition, VetsMediCover will become part of Insync Insurance, a digital broker that GRP acquired in December 2020

- In August 2023, Go Digit General Insurance collaborated with Vetina Healthcare LLP to offer extensive insurance coverage for dogs to Vetina Family members

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Explore Horizon, the world’s most expansive market research database